Created in 2009, cryptocurrencies appeared on the scene as an alternative to traditional banking and financial markets. However, many of today’s banking and financial institutions are betting on blockchain technology and cryptocurrencies to improve their system. In addition, many of the newly created cryptocurrencies are trying to enter the traditional financial market as well.

In reality, it is not surprising that banking entities go hand in hand with cryptocurrencies. The future of traditional banking would be null if it does not evolve and adapt to the advance of New Technologies.

Our financial system continues to be anchored in a model that was developed in the second half of the last century. It has been enduring the challenges of time with various technological patches, which in reality have not achieved an effective adaptation to the digital age.

The cryptocurrency revolution

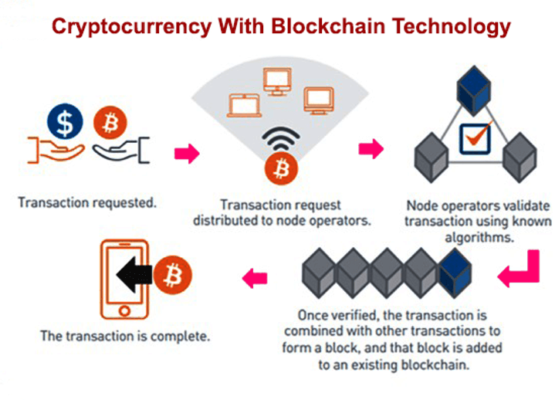

The arrival of cryptocurrencies has meant a disruptive process in the financial landscape, providing a greater number of benefits for the user. In this sense, customers do not need intermediaries to carry out their economic transactions. In addition, these processes are immediate, can be carried out from any mobile device, and give access to a global economy.

The financial system is at the service of all

It must be taken into account that there are more than 2,000 million people around the world who cannot access the services of a traditional bank. Decentralized-identities appearance of cryptocurrencies came to alleviate this situation. It has allowed them to participate at the global economic level. This has meant a real revolution that includes the opportunity to move away from poverty.

This way of operating is promoting the appearance of monetary networks that are established between equals. It is increasingly common to attend this type of link. The direct consequence for the financial industry translates into a real threat to the entire sector.

The reason for the bank’s fear? Peer-to-peer operations with cryptocurrencies escape centralized control. In addition, transferring money internationally is faster and cheaper.

The BBA UK report “ Digital Disruption: UK Banking Report ” makes this very clear. For the experts, with the use of Bitcoin, people manage many requirements themselves that, until now, required a bank. Now, interacting with a bank is unnecessary and the user even saves on commissions.

Is traditional banking extinct?

Digital currencies have come to shake the foundations of a sector that lived anchored in the past. The evolution of traditional banking has not walked in parallel with the needs that were being generated in customers. As the world plunged into the industrial revolution 4.0. Sectors and businesses have had to face a powerful change that would keep them in the market and competitive.

Banking entities have tried to delay, if not avoid, an inevitable transformation process. Even the Central Banks have not been able to pronounce themselves. In any case, even if they arrive late, they have no choice but to reinvent themselves and cryptocurrencies are just the tip of the iceberg against which they can crash.

If they want to stay competitive, the big banks have to undertake a deep process of digitization. They must be prepared to offer, in real-time, the options and services that, as a user, are achieved by operating with cryptocurrencies.

The most notable banks in the sector have indeed begun to invest in research and develop blockchain technology. The intention is to be able to recover ground and establish itself in the field of digital banking.

goodbye malpractice

Apart from technological renewal, traditional banking must get rid of the halo of mistrust that surrounds it in the eyes of the consumer. For decades, banks have been in the crosshairs of the discontent of users who, not without a good dose of impotence, attended unethical procedures.

Account manipulations, the application of debits rather than credits, the collection of commissions, abusive clauses, the obligation to buy financial products… and a long etcetera, have ended up instilling in the client a feeling of generalized distrust. Now, this sector has to learn that, with digitization, customers have access to all their movements through a simple smartphone. These banking practices have their days numbered.

To deal with this situation, there are already banks that are trying to improve their image. To do this, they have focused, among other things, on improving their customer service, offering digital options, and reducing or even eliminating commissions.

In any case, in the opinion of banking experts, traditional banks must bet on digital solutions that go beyond their entrenched barriers. This means that they must go beyond being satisfied with applying, in a standardized way, some options such as mobile banking.

Amid the disruptive process in which the financial system finds itself, if they do not abandon the practices of the past and embrace the profound transformation they need, they are in danger of being left behind. Specialized publications such as American Banker encourage banks by stating that cryptocurrencies can also represent an opportunity for banks. The magazine points out that issues such as how to process payments, facilitate international cash transactions, allow the exchange of bitcoins for current currency, or dare to grant virtual currency loans, could boost the sector.

Traditional banking vs cryptocurrencies, changing financial markets. In recent times there has been a certain transformation in the behavior patterns of some traditional banks and financial institutions. They seem to have wanted to open a gap in the field of cryptocurrencies and blockchain. According to what they say, they want to implement improvements in the bank network. The truth is that new cryptocurrencies have been created that, hand in hand with banks, try to access the traditional banking market.