Cryptocurrencies have disrupted traditional financial systems, and with it, the need for decentralized exchange platforms has emerged. Decentralized exchanges (DEX) are revolutionizing the way people trade digital assets. In this article, we will explore the concept of decentralized exchange development, its advantages, key features, popular protocols, and the future it holds.

Introduction

With the rise of cryptocurrencies, the demand for secure and efficient trading platforms has increased. Decentralized exchanges offer a solution by eliminating the need for intermediaries and enabling peer-to-peer transactions. Unlike centralized exchanges that rely on a central authority to hold user funds, decentralized exchanges provide users with full control over their assets.

Understanding Decentralized Exchanges (DEX)

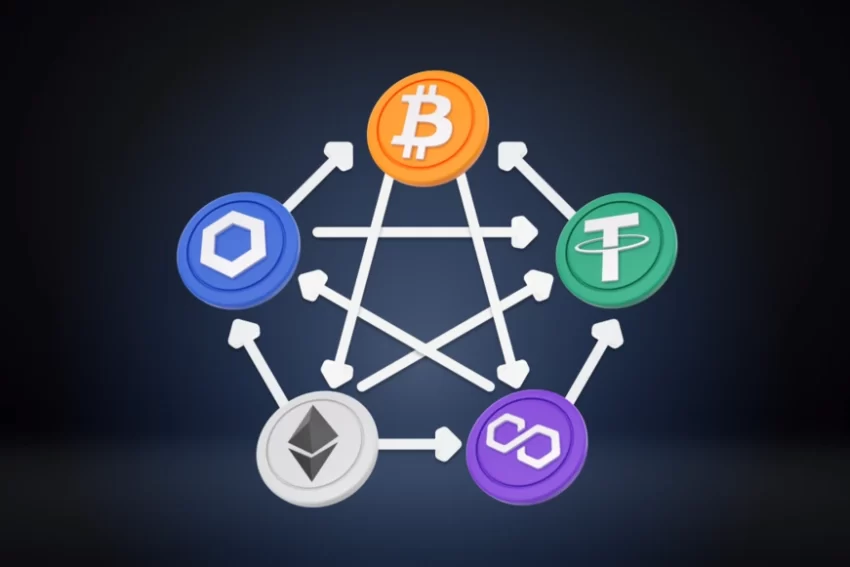

Decentralized exchanges, or DEX, are platforms that facilitate the direct exchange of digital assets between users on a peer-to-peer basis. They operate on blockchain technology, enabling transactions to be executed without the need for a central authority. By utilizing smart contracts, DEXs automate the process of matching buy and sell orders, providing transparency and security.

Advantages of Decentralized Exchange Development

- Enhanced Security: Unlike centralized exchanges, which are vulnerable to hacking and insider threats, DEXs offer enhanced security by eliminating the need for a single point of failure. Users retain control over their private keys, reducing the risk of unauthorized access.

- Greater Privacy: Decentralized exchanges prioritize user privacy by allowing transactions to be conducted without the need for KYC (Know Your Customer) procedures. This appeals to individuals who value anonymity in their financial transactions.

- Reduced Counterparty Risk: In decentralized exchanges, users have full control over their funds, eliminating the risk of exchange insolvency or exit scams. Smart contracts ensure that transactions are executed as agreed upon, reducing counterparty risk.

- Global Accessibility: Decentralized exchanges enable anyone with an internet connection to participate in trading, removing geographical restrictions and promoting financial inclusion.

Key Features of Decentralized Exchanges

- Non-Custodial Wallets: DEXs allow users to maintain control over their private keys and funds by utilizing non-custodial wallets. This ensures that users have full ownership and control over their digital assets.

- Smart Contract Execution: Decentralized exchanges rely on smart contracts to automate the process of executing trades. These contracts act as self-executing agreements, enabling secure and transparent transactions.

- Liquidity Pools: Many DEXs utilize liquidity pools, where users can contribute their assets to provide liquidity for trading. Liquidity providers earn fees based on their contribution, fostering a vibrant trading ecosystem.

- Interoperability: Some decentralized exchanges leverage cross-chain technology to enable the exchange of assets across different blockchain networks. This allows users to trade a wide range of cryptocurrencies seamlessly.

Popular Decentralized Exchange Protocols

- Uniswap: Uniswap is one of the most well-known decentralized exchange protocols built on the Ethereum blockchain. It utilizes an automated market maker (AMM) model and has gained significant popularity due to its ease of use and liquidity.

- SushiSwap: SushiSwap is another Ethereum-based DEX protocol that offers additional features such as yield farming and staking. It has gained attention for its community-driven development and innovative tokenomics.

- PancakeSwap: PancakeSwap operates on the Binance Smart Chain and has gained traction among users due to its lower transaction fees and compatibility with the Binance ecosystem.

Steps to Build a Decentralized Exchange

- Define the Requirements: Determine the features, security measures, and supported blockchain networks for your decentralized exchange.

- Choose a Blockchain Platform: Select a blockchain platform that aligns with your project requirements, such as Ethereum, Binance Smart Chain, or others.

- Develop Smart Contracts: Build and audit the smart contracts that will handle the core functionalities of the decentralized exchange, including order matching and asset transfers.

- Design the User Interface: Create an intuitive and user-friendly interface for traders to interact with the decentralized exchange.

- Implement Security Measures: Implement robust security measures, including encryption, multi-factor authentication, and third-party security audits.

- Launch and Test: Deploy the decentralized exchange on the selected blockchain network and conduct thorough testing to ensure functionality and security.

Security Considerations for Decentralized Exchanges

- Smart Contract Audits: It is crucial to conduct comprehensive smart contract audits to identify and fix vulnerabilities before launching the decentralized exchange.

- Secure Key Management: Implement secure key management practices to safeguard user funds and prevent unauthorized access.

- Continuous Monitoring: Regularly monitor the decentralized exchange for any suspicious activities or vulnerabilities and promptly address them.

Regulatory Challenges and Compliance

Decentralized exchanges operate in a rapidly evolving regulatory landscape. While they offer various advantages, compliance with regulations is crucial for their long-term viability. The challenges include AML (Anti-Money Laundering) and KYC requirements, tax considerations, and ensuring adherence to local financial laws.

Conclusion

Decentralized exchange development has brought forth a new era of secure and transparent trading. By leveraging blockchain technology and smart contracts, DEXs offer enhanced security, privacy, and global accessibility.

Also read: Revolutionizing the gaming industry in Blockchain